QuickBooks Online’s cash circulate forecasting tools can even provide a real-time snapshot of your out there funds, serving to you intend payments extra strategically. Even with automation, it’s important to match outgoing funds regularly in opposition to vendor invoices and accounting records. When you arrange ACH payments in QuickBooks Online, the method is simple. After getting into your vendor’s financial institution info into their profile, you probably can select to ship funds electronically rather than issuing a examine.

How Benji Pays Helps

Once here, you presumably can choose the kind of tax price you wish to set up, enter the relevant particulars, and select Save. Be Taught the ins and outs of QuickBooks’ Multicurrency features and how to get extra out of your global payables with QuickBooks integration add-ons. However with MineralTree’s seamless integration with QuickBooks, you can simplify the whole course of. QuickBooks On-line and QuickBooks Desktop facilitate sending and receiving worldwide funds. Discover features, costs, and benefits to choose the most effective cost platform on your growing firm.

Your enterprise could make QuickBooks international funds notably properly with an end-to-end AP automation software program integration. To use MineralTree for QuickBooks worldwide payments, join your account to QuickBooks (Online or Desktop), allow international payments, and sync your vendor bills. MineralTree costs a nominal fee for wire funds along with any FX fees. To accept global ACH bank switch payments from customers, you need an add-on app because QuickBooks Online lacks this function. Consider Melio, PayPal, or Sensible for accounts receivable features, similar to receiving international funds from clients.

Features

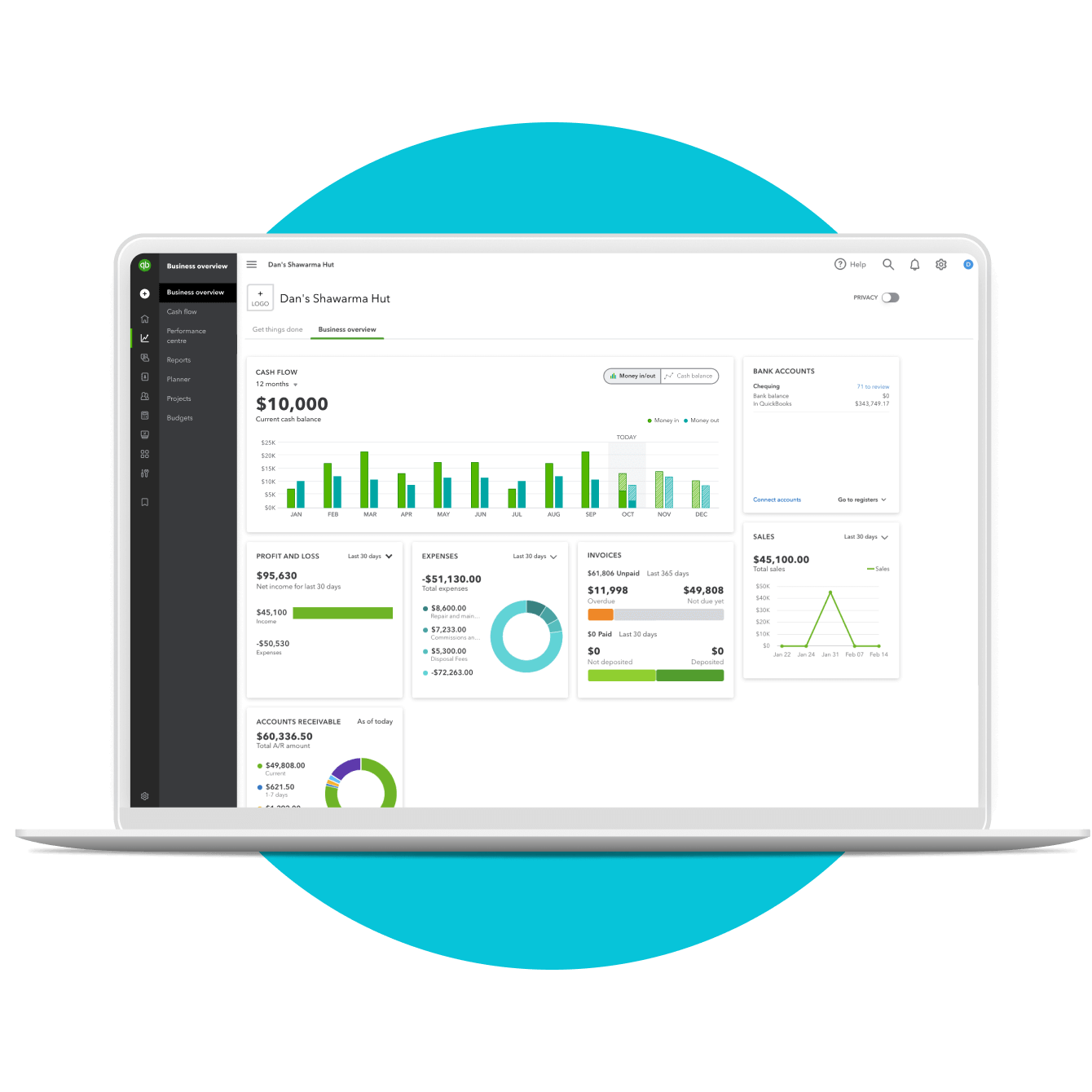

For QuickBooks Online users accredited and enrolled in QuickBooks Payments, QuickBooks Funds processes the customer’s fee. Recording buyer payments in the appropriate accounts is handled automatically by QuickBooks Online software program. Small businesses and medium-sized businesses use QuickBooks Online bookkeeping and accounting software. Suppliers utilizing QuickBooks Online can bill and settle for buyer payments. QuickBooks integrates with global banks and ERP techniques to automate worldwide payments and streamline transaction monitoring. This includes connections with international banking platforms, and permitting for automation of international funds.

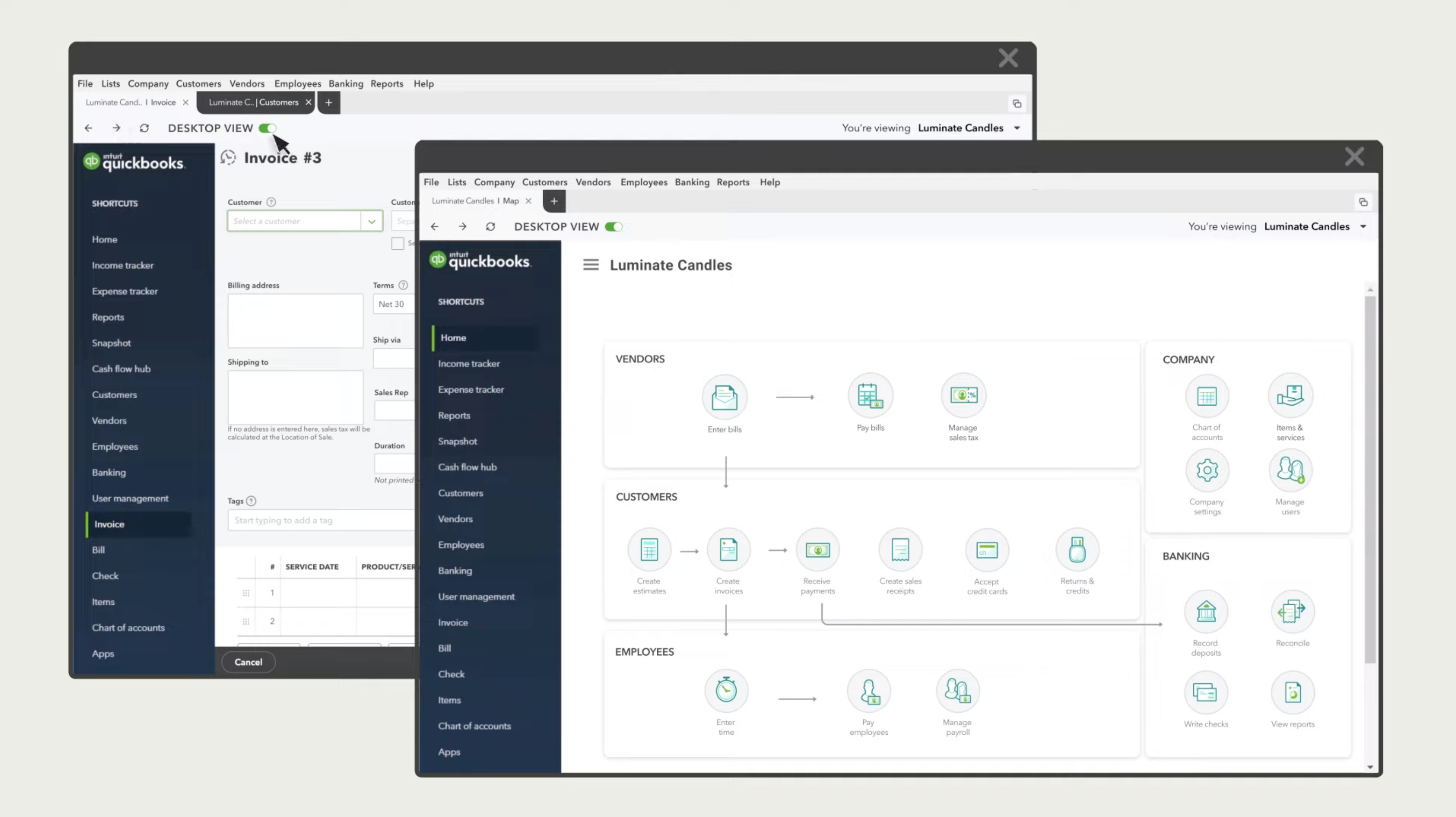

This guide exhibits you tips on how to receive and settle for payments by way of QuickBooks Online, which is real-time cloud software. With QuickBooks On-line, your corporation can receive payments with different cost methods, such as credit card, debit card, ACH financial institution switch, or PayPal. QuickBooks Funds lets you embrace links in your invoices, making it straightforward on your customers to pay online.

- For example, Tipalti AP automation software program is a third-party add-on for QuickBooks On-line (or QuickBooks Desktop) that automates provider invoice processing, including international funds.

- Once vendor financial institution details are entered, payments may be despatched directly to their account with just some clicks.

- Utilizing QuickBooks Funds, you possibly can select your favourite cost kind and ship online invoices to your customers with a Pay Now button.

- If the seller prefers direct deposit, a mailed examine, or another methodology, QuickBooks lets you document that desire, so you’ll find a way to select the right possibility mechanically when it’s time to pay.

- You May be prompted to choose your cost technique, the place QuickBooks permits you choices corresponding to financial institution transfers, checks, or different fee gateways that you’ve got set up.

How Quickbooks On-line Supports Vendor Payments

If clients aren’t paying, take a look at totally different communication formats or follow-up timing. The price is variable and depends on elements like your plan of choice, what quantity of transactions you complete, what sort of transactions you make, etc. Learn tips on how to pay outsourced staff in compliance with US legal guidelines, the difference between staff and contractors, one of the best payment choices, and key tax rules. Airwallex also expenses a zero.5% to 1% exchange price markup on all conversions, depending on the foreign money. With iBanFirst, there isn’t any setup charge, no monthly subscription costs and no hidden fees — what you see is precisely what you pay.

QuickBooks Funds automatically moves processed transactions into your accounts to record the bank deposit. With QuickBooks Payments, you don’t should put transactions into the “Undeposited funds account” first to record bank deposit details. Set your systems up properly, keep consistent, and evaluate your cash circulate typically. A little time spent organizing vendor funds now can save a lot of https://www.quickbooks-payroll.org/ bother (and a lot of money) down the road.

They give you flexibility without sacrificing professionalism, and they cut down on time spent chasing funds or fixing handbook errors. Whether Or Not you’re amassing deposits, event funds, or balances, fee links allow you to stay in charge of your cash move. QuickBooks cost hyperlinks offer a clear, trendy answer for every thing from sending a one-off request to embedding a cost possibility into an bill. These hyperlinks help your business receives a commission quicker with out the extra admin. It Is disappointing you want to turn on multi-currency vendors to send a global cost in USD.

You can see when your fee clears your account, which intermediary banks it’s routing through, and when it is anticipated to land in your beneficiary’s account. These providers flip what was a fancy, costly process into something manageable and advantageous for you. One of essentially the most essential processes when utilizing QuickBooks accounting software is receiving a customer’s cost for sales transactions.

Bill Pay helps make certain you does quickbooks accept international payments by no means miss a deadline, and by automating components of the process, it frees up time for extra strategic monetary work. Setting cost preferences up entrance saves time when payments are obtainable in, and it keeps your payment workflow organized across different vendors. Somewhat than juggling totally different platforms to ship cash, replace books, and observe payments, companies can handle everything directly inside QuickBooks.

No comment yet, add your voice below!