Under strict money basis accounting, this revenue would be absent from the year’s monetary data, doubtlessly skewing the annual performance metrics. The modified technique, nonetheless, would include this within the yr’s revenue, reflecting the work carried out and providing a more true illustration of the year’s efforts. The Tax Cuts and Jobs Act increased the number of small enterprise taxpayers entitled to use the money foundation accounting methodology. As of 2024, small enterprise taxpayers with average annual gross receipts of $30 million or less within the prior three-year period can use it.

- Therefore, modified cash foundation accounting may be deemed as an economical method of bookkeeping.

- Connect your business’s revenue statement as well as balance sheets from the earlier 12 months.

- The integration of blockchain know-how and cloud-based options will revolutionize how monetary knowledge is managed and reported, shaping the way forward for accounting practices.

- With accrual basis accounting, income is recorded when it is earned and expenses are recorded when they are incurred.

- These changes may embody accounts receivable for revenue earned however not but received in money.

Cash basis accounting, an easy approach, records revenues and bills only when cash modifications palms. Contrastingly, modified cash basis accounting presents a hybrid resolution, blending components of accrual accounting with the simplicity of the money basis methodology. Modified cash basis accounting recognizes revenues when they’re obtained, rather than when they’re earned (as within the money basis). However, it modifies the pure cash foundation by additionally including certain accruals, significantly for important belongings and liabilities, like accounts payable, accounts receivable, and depreciation on long-term assets.

.jpeg)

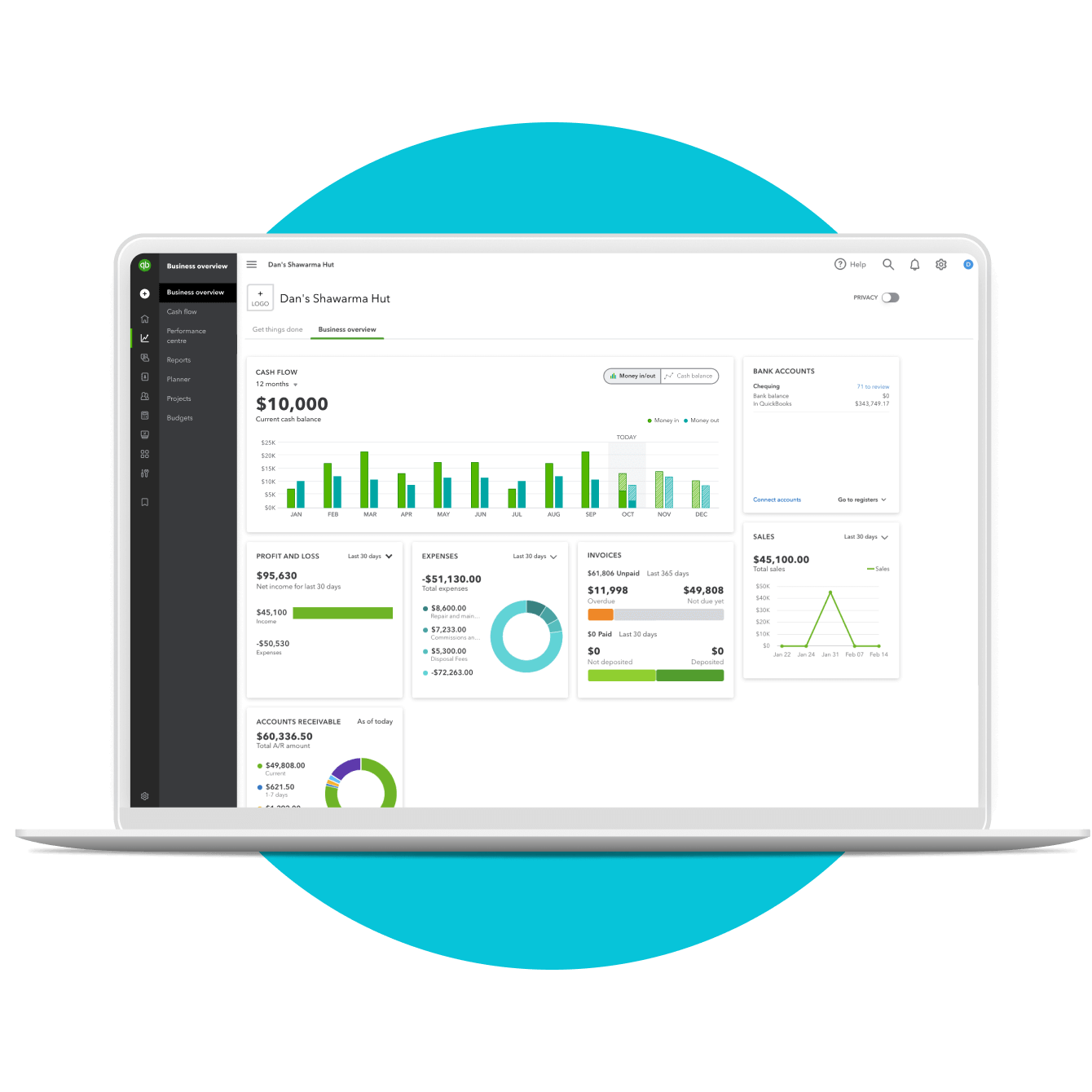

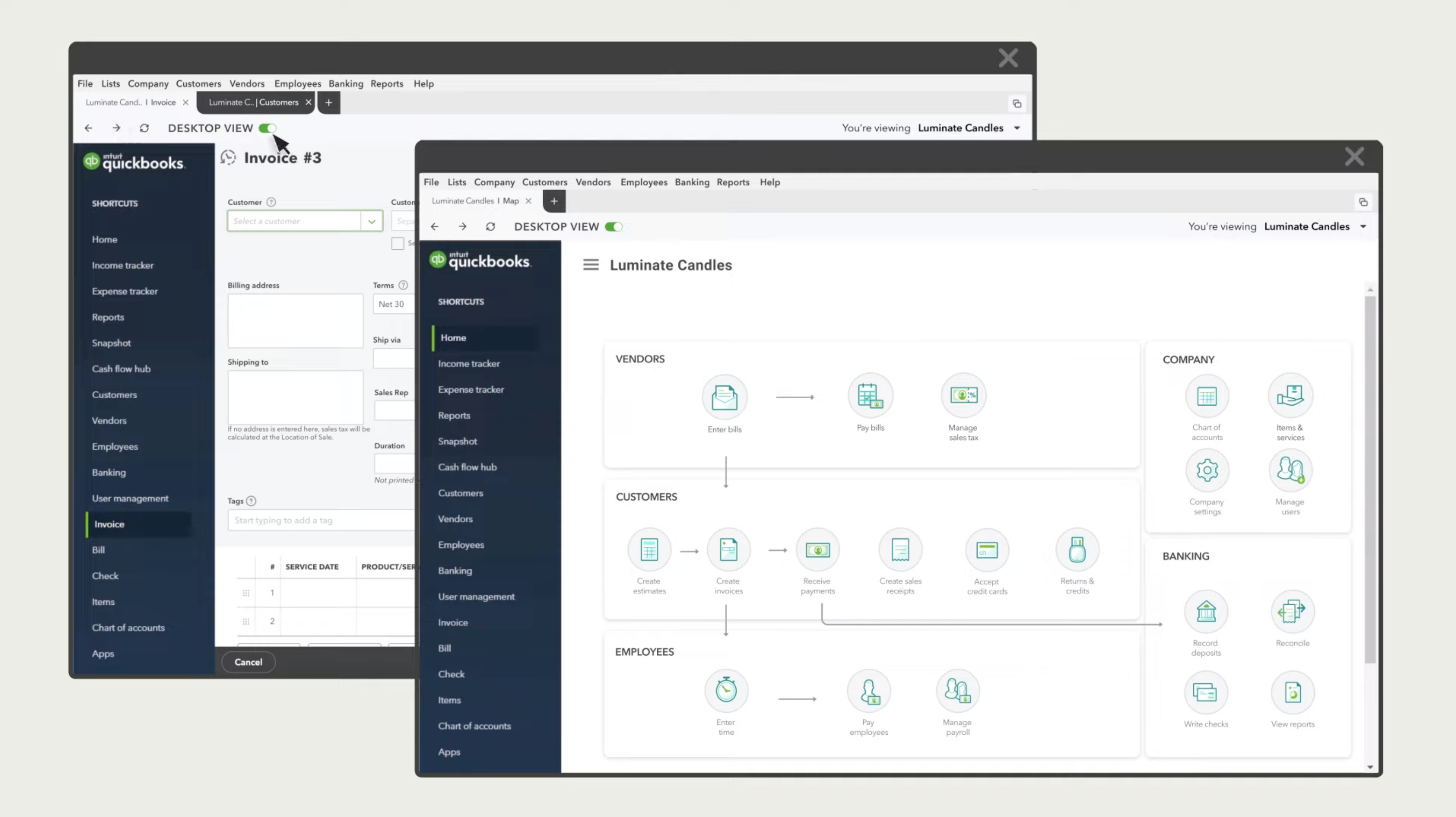

This was once done by hand on paper, but now enterprise homeowners primarily do this using bookkeeping software program. The cash methodology is also beneficial by method of tracking how a lot money the enterprise actually has at any given time; all you need to do is take a look at your bank account stability. Navigating the complexities of tax and accounting requirements is a crucial side of running a small enterprise. Type 3115, titled “Application for Change in Accounting Method,” is crucial for companies seeking to switch from one accounting method to another. With modified cash-basis accounting, you only document expenses and income if you receive or pay cash.

Entities using this method do not document receivables, payables, accruals, or deferrals in a conventional sense—most noncash actions merely do not appear in the financial information until a cash transaction occurs. Suppose a business purchases office equipment on credit, making no money cost upfront. Under full cash basis accounting, this transaction would not be recorded until the money fee is made.

.jpeg)

For traders, it’s essential to grasp the impact of both strategies when making investment choices. This means a invoice doesn’t show in monetary information until payment has been made. For example, if an organization receives an invoice for companies in January however doesn’t pay the invoice till February, the expense would present up in February. The profit of cash accounting is that it provides a easy and easy view of the money move of a business. It is simple to understand and does not require sophisticated accounting practices for use.

Understanding your corporation needs is essential to selecting the best accounting method. These forms of Changes In Accounting Methods From Cash To Modified Cash business sometimes have smaller accounting departments or even just single-bookkeeper systems making the simpler and more direct nature of modified cash foundation accounting a good selection. The reduced complexity and prompt reflection of cash flows additionally help these companies to more successfully control and monitor their spending without needing the administrative overhead of extra complex strategies. Different industries can profit from modified cash accounting primarily based on their specific wants.

Money basis accounting data revenue and expenses when precise funds are obtained or disbursed. On the other hand, accrual accounting data revenue and expenses when those transactions occur and earlier than any money https://www.kelleysbookkeeping.com/ is acquired or paid out. In money foundation accounting, income is recorded only when cash is definitely obtained. A business recognizes revenue at the moment fee is collected, no matter when the services or products was delivered.

.jpeg)

To compare money, accrual, and hybrid strategies in more depth, discover our cash-vs-accrual guide or evaluate our full range of bookkeeping packages. Choosing the best accounting methodology for your small business shapes how clearly you see the monetary well being of your operations. Beneath the accrual technique, the $5,000 is recorded as revenue as of the day the sale was made, although you might obtain the money a few days, weeks, and even months later. The overwhelming majority of corporations that folks would doubtlessly invest in shall be utilizing accrual-based accounting. However, should you come throughout a small company using cash-based accounting, it’s positively one thing to be careful for.

Modified Money Basis Accounting – This hybrid method weaves a extra advanced tapestry. It combines parts of accrual accounting with the cash basis, permitting for a broader perspective. Under this technique, the expense is recorded when the beans are received, not when the invoice is paid, providing a glimpse of future money obligations. The primary distinction between accrual and cash foundation accounting lies within the timing of when income and bills are acknowledged. The money technique provides an instantaneous recognition of income and expenses, whereas the accrual method focuses on anticipated income and expenses.

Modified cash foundation accounting is a method between cash and accrual accounting systems, giving businesses a chance to make the most of features of each methods. In this section, we’ll explore superior elements of modified cash basis accounting, focusing on handling long-term objects and account changes. For instance, the IRS in the Usa allows small companies with common annual gross receipts of lower than $25 million to use the money or modified money basis accounting for tax reporting functions.